SIP Calculator - Calculate Mutual Fund SIP Returns Instantly & Plan Your Investments

Easily Estimate Your SIP Growth & Plan Smart Investments

Use our free SIP calculator to estimate mutual fund SIP returns based on investment amount, tenure, and expected returns. Whether you're investing for retirement, education, or wealth creation, our online SIP calculator helps you make data-driven investment decisions

SIP Returns Calculator – Estimate Your Mutual Fund SIP Growth & Wealth Creation

SIP Calculator

Compare Daily, Weekly & Monthly SIP Returns for Better Investment Planning

Choosing the right Systematic Investment Plan (SIP) is crucial for long-term wealth creation. A SIP Calculator helps you understand how daily, weekly, and monthly SIP investments can impact your financial growth. Whether you are a beginner or an experienced investor, this tool enables you to plan smartly and optimize your mutual fund investments.

With the SIP Calculator, you can:

✔️ Estimate the future value of your SIP Investments.

✔️ Plan your Financial goals efficiently.

✔️ Compare different investment scenarios.

✔️ Adjust SIP Amounts based on inflation & market trends.

What is a SIP Calculator? – Calculate SIP Returns for Mutual Fund Investments

A SIP Calculator is an essential financial tool that helps investors estimate their potential mutual fund returns based on monthly SIP investments, expected returns, and investment tenure. Whether you are a beginner or an experienced investor, this tool allows you to calculate how much you need to invest to meet your financial goals. By using a Systematic Investment Plan (SIP), investors can leverage the power of compounding to build wealth over time.

📌 Why Use a SIP Calculator?

✔ Accurate Return Estimation – Get a real-time projection of your SIP maturity amount.

✔ Customizable Investment Planning – Adjust your monthly SIP to meet financial goals.

✔ Compare Different Scenarios – See how investment tenure & expected returns impact growth.

✔ Plan for Inflation – Ensure your investments outpace inflation for long-term security.

How to Use a SIP Calculator Online to Estimate Mutual Fund SIP Returns

Step-by-Step Guide to Using a SIP Calculator:

✔ Enter the Monthly SIP Investment Amount – Decide your monthly SIP contribution for better financial planning.

✔ Specify the Expected Annual Return Rate (%) – Choose an estimated return percentage (10-15%) based on mutual fund past performance.

✔ Provide the Investment Duration (Years) – The longer the tenure, the higher the compounding effect.

✔ Click 'Calculate' to Get Projected Future Value – Get a detailed projection of your investment maturity amount and gains.

How a Mutual Fund SIP Returns Calculator Works – Calculate SIP Growth Instantly

A Mutual Fund SIP Returns Calculator is an essential tool for investors looking to plan their long-term wealth. By entering key details such as Monthly SIP Amount, Expected Return Rate, and Investment Duration, investors can estimate their future wealth growth. The calculator simplifies complex SIP investment analysis, ensuring that investors make informed decisions about their financial goals.

Key Parameters Used in the SIP Calculator:

✔ Monthly Investment Amount (P) – Your fixed monthly contribution to the SIP.

✔ Expected Rate of Return (r) – The assumed annualized return (typically 10-15% for equity funds).

✔ Investment Duration (n) – The total number of years you plan to continue investing in your SIP.

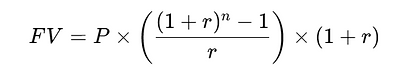

SIP Compound Interest Formula – How SIP Calculator Predicts Mutual Fund Returns

The SIP Calculator Formula is based on the principle of compound interest, where the returns generated from investments are reinvested to accelerate wealth creation. This formula helps investors estimate their future returns on mutual fund SIPs, making it a powerful tool for financial planning.

SIP Calculation Formula:

Where:

📌 FV = Future Value of the SIP Investment

📌 P = Monthly SIP Investment Amount

📌 r = Expected Return Rate (in decimal form)

📌 n = Number of SIP installments

SIP Investment Example – How ₹5,000/month Grows into ₹11.6 Lakhs in 10 Years!

Systematic Investment Plans (SIP) are a powerful way to build wealth over time. Here’s how your ₹5,000/month SIP grows using the power of compounding.

Scenario: You invest ₹5,000 per month in a SIP for 10 years at a 12% expected return.

🔹 Monthly Investment (P): ₹5,000

🔹 Annual Return Rate: 12% (or 0.12)

🔹 Total Installments (n): 10 years × 12 months = 120 SIPs

Future Value Calculation:

💰 ₹11,61,695

✔ Total Invested: ₹6,00,000

✔ Total Gains: ₹5,61,695

Benefits of Using a SIP Calculator

A Mutual Fund SIP Calculator simplifies investment planning and provides several benefits:

1️⃣ Informed Decision-Making

✔️ Provides an accurate estimate of future returns, helping investors make better financial choices.

2️⃣ Financial Planning & Goal-Setting

✔️ Assists in planning short-term & long-term financial goals like retirement, education, or buying a house.

3️⃣ Easy & Instant Results

✔️ Requires minimal inputs and generates results instantly.

4️⃣ Saves Time & Eliminates Manual Errors

✔️ No complex calculations—just enter your details, and the SIP calculator does the math!

5️⃣ Compare Investment Scenarios

✔️ Adjust values to see different SIP investment outcomes based on market trends & inflation.

Best SIP Calculators in India – Which One Should You Use?

When searching for an SIP calculator, you’ll find multiple options from different banks and financial platforms. Below is a comparison of the most popular mutual fund SIP calculators:

Top Mutual Fund SIP Calculators Available Online

✔ SBI SIP Calculator – Estimate SIP returns for SBI Mutual Funds.

✔ HDFC Mutual Fund SIP Calculator – Used for HDFC mutual fund SIP planning.

✔ ICICI SIP Calculator – Calculates expected returns for ICICI mutual funds.

✔ Axis Bank SIP Calculator – Helps in SIP planning with Axis Bank funds.

✔ Kotak SIP Calculator – Designed for Kotak Mutual Fund investments.

✔ LIC SIP Calculator – Focused on LIC’s mutual fund schemes.

Why Choose AssetPlus SIP Calculator Over Bank SIP Calculators?

While different calculators provide basic SIP estimates, the AssetPlus SIP Calculator stands out with advanced features:

🔹 Annual Step-Up Calculation – Adjusts SIPs for inflation & income growth.

🔹 Multi-Scenario Comparisons – Compare SIP vs Lumpsum investments.

🔹 Customization Options – Flexible SIP frequencies (daily, weekly, monthly).

🔹 All Mutual Fund Schemes – Works with all AMCs, not just one bank’s funds.

How to Use the AssetPlus SIP Calculator?

✅ Scroll above & input the following details:

📌 Investment amount.

📌 Investment duration.

📌 Expected rate of return.

📌 Annual increment (optional).

📌 View Instant Results – Total invested amount, future value, and inflation-adjusted growth.

📌 Adjust Investment Variables – Compare different scenarios effortlessly!

The AssetPlus Mutual Fund SIP Calculator helps you make well-informed investment decisions backed by accurate projections.

💡 Pro Tip: Combine this tool with expert financial advice for maximum returns.

Why Every Investor Needs the SIP Calculator?

A SIP Calculator is an essential investment planning tool for both beginners and experienced investors.

🔹 Key Takeaways:

✔️ A SIP calculator simplifies mutual fund investment planning.

✔️ It works on the principle of compounding to calculate future returns.

✔️ Requires basic inputs like SIP amount, return rate, and duration.

✔️ Helps in financial goal-setting, investment comparisons & decision-making.

🚀 Get started today! Use the AssetPlus SIP Calculator and take control of your financial future.